Absolute return targets tend to be popular inside hedge fund business and are usually achieved through leverage and alpha in accordance with various marketplace betas. As a result, you are able to develop a valuation-based “rule of thumb” computation the implied leverage that hedge fund techniques need given market valuations.

Absolute return targets tend to be popular inside hedge fund business and are usually achieved through leverage and alpha in accordance with various marketplace betas. As a result, you are able to develop a valuation-based “rule of thumb” computation the implied leverage that hedge fund techniques need given market valuations.

Typical metrics, such as for instance notional, moderate, and web leverage, could be complicated or annoying for people to understand provided their particular structure and spectral range of values. Candidly, using these standard metrics doesn't appear many efficient way to communicate leverage into the average investment committee user, and also require trouble comprehending all the underlying computations. Clearly, we require a less complicated answer that much better reflects the implied leverage customers tend to be asking their supervisors to just take.

Because control is an immediate purpose of valuations, which are a result of the absolute return objectives set by supervisors and their customers, a control metric could be produced from fundamental algebra and a couple of simple assumptions.

We call this computation the Implied Hedge Fund Leverage Ratio™. It's user friendly and gives a pragmatic knowledge of the control related to any hedge fund strategy according to prevailing market valuations.

How Come This Idea Matter Today?

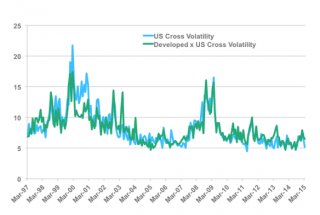

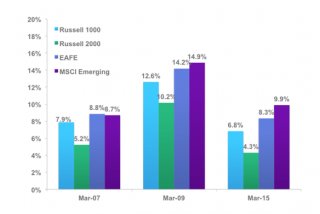

This matter is applicable today because we're in a low-return, challenging alpha environment as a result of financial stimulation compression valuations additionally the cross-volatility of asset comes back. These problems are succinctly illustrated with a few charts that demonstrate the cross-volatility of developed market equity comes back (proxy for rates opportunities) and implied returns for significant asset classes before, during, and following the last bear marketplace.

Russell Equity Cross Volatility Index

Profits and Dividend Yields (Implied Comes Back)

Yields to Maturity

What's the Implied Hedge Fund Leverage Ratio Equation?

The initial an element of the Implied Hedge Fund Leverage Ratio is based on the presumption that the manager’s gross comes back must meet with the client’s anticipated return objective internet of management and motivation costs.

This worth is derived as

This worth is derived as

where

- Rg = Gross needed return

- Rc = Client return hurdle/expectation for trading

- We = Incentive charges as a per cent of earnings

- F = Fees

Furthermore, when a client’s return challenge is famous, implied portfolio leverage are computed by using a proper beta for method and the client’s alpha objectives.

This price is derived as

- L = suggested influence to promote beta

- Rg = Gross required hedge return

- B = marketplace beta of method

- A = Alpha expected by customer

Exactly how Are Betas Selected for assorted Techniques?

Hedge investment managers typically dislike becoming involving marketplace betas because their particular methods are complex and involve securities much more complicated than, state, the S&P 500 Index. But derivatives are based on market betas and are usually, therefore, driven by all of them. The following are examples of just how betas could be chosen for a few common methods.

Long–Short Equity Managers

- Because of this method, we utilize the S&P 500 because these supervisors’ returns follow the index really closely eventually.

Credit Managers

- For a credit manager, beta is a direct purpose of the manager’s amount of credit danger (or the yield to maturity).

Arbitrage Managers

- These managers calculate prospective profits in accordance with their particular price of money, the centerpiece of any arbitrage calculation. Any investment must surpass the expense of money becoming undertaken, causeing the the standard for pre-leverage returns, a relationship which can be seen in aggregate overall performance over time of these methods. Therefore, for arbitrage managers, we find the price of money once the beta.

Commodity Trading techniques

Commodity Trading techniques

- Choosing this beta is much more theoretical in nature but rather easy to derive because return expectation for many natural sources eventually could be the price of capital, causeing this to be the baseline return for holding commodities.

Samples of the Equation

Before determining examples of the Implied Hedge Fund Leverage Ratio, we have to make some basic assumptions:

- The client’s return objective is 10% internet of charges. This presumption will be based upon long-term public marketplace returns, expected supervisor alpha, a little illiquidity advanced, and typical hedge investment supervisor return targets.

- Administration costs are 1% and incentive fees are 20per cent of profits

Sample 1: Long–Short Equity Manager

Implied Leverage Ratios for Long/Short Equity Managers

Implied equity comes back when it comes to Russell 1000 Index are used since the beta in preceding control calculations and eventually show a huge distinction among these times.

Sample 2: Credit Management

Implied Control Ratios for Credit-Based Hedge Fund Techniques

This instance makes use of the Barclays US tall Yield Index given that beta for a credit-based hedge fund method running in the middle selection of the credit spectrum. Once more, we can observe marketplace valuations affect potential leverage and that suggested influence is higher now than before the final bear marketplace.

Sample 3: Arbitrage Management

Implied Influence Ratios for Arbitrage Techniques

For this example, we utilize the Barclays United States Credit Index while the beta, and/or cost of money, and baseline return expectation that must definitely be surpassed for almost any financial investment to-be made pre-leverage. We can plainly start to see the aftereffects of low interest rates on implied influence ratios given March 2015 values.

Example 4: Commodity Manager

Suggested Control Ratios for Commodity Managers

As stated earlier, the long-term price of capital may be the baseline return hope for most natural sources. Consequently, we use the Barclays United States Long Credit Index as the beta for this calculation.

These examples tend to be intriguing and would draw critique through the hedge investment business regarding their efficacy. Nonetheless, the theories are sound from a huge photo perspective and tell us conclusively that capital market conditions have become conducive to large quantities of influence.

Increasing control during a Low-Return Environment Is a Bad Idea

Witnessing implied leverage ratios much like those ahead of the final bear market is not the best thing from a threat management perspective. The examples offered clearly show just how sturdy equity valuations, reduced fixed-income yields, and lowered alpha opportunities strongly encourage supervisors to take on additional leverage to meet clients’ return targets.

YOU MIGHT ALSO LIKE