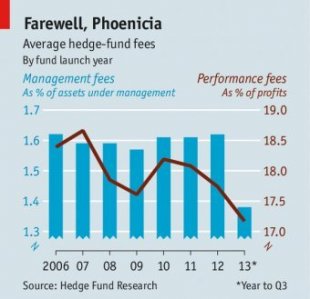

PHOENICIAN merchants kept a fifth associated with profits produced from their seafaring activities and given out the others to their financiers. Therefore reported Alfred Winslow Jones, the manager of this first modern hedge investment, whom in the 1950s used the (perhaps apocryphal) precedent to finagle a 20per cent cut from his backers. Other managers consequently added a 2% yearly cost on assets they invested to reach during the “2 and 20” formula that became the conventional both for hedge funds and private equity. Investors, who have long suspected that arrangement enriches managers faster than their customers, are belatedly fighting back. They have been successful in amending the formula to something more like “1.4 and 17”, at least for newcomers to the company (see chart).

PHOENICIAN merchants kept a fifth associated with profits produced from their seafaring activities and given out the others to their financiers. Therefore reported Alfred Winslow Jones, the manager of this first modern hedge investment, whom in the 1950s used the (perhaps apocryphal) precedent to finagle a 20per cent cut from his backers. Other managers consequently added a 2% yearly cost on assets they invested to reach during the “2 and 20” formula that became the conventional both for hedge funds and private equity. Investors, who have long suspected that arrangement enriches managers faster than their customers, are belatedly fighting back. They have been successful in amending the formula to something more like “1.4 and 17”, at least for newcomers to the company (see chart).

The principal reason for the erosion may be the bad returns that “alternative possessions” have brought. Hedge funds overall have actually undershot any standard lately, maybe not minimum buoyant stockmarkets. Numerous investors in exclusive equity, for his or her part, tend to be wondering if they are becoming adequately rewarded for tying up their cash for 10 years or higher. As it is the net return that matters to investors, trimming charges gets better a fund’s observed overall performance. The absolute most successful ones—which often have their choose of investors—can nonetheless charge really above “2 and 20”; for remainder, haggling is actually common.

Another element is the dash of new people into choices, with pension resources, endowments and other institutions now outweighing wealthy people. This new consumers are not only savvier; in addition they write bigger cheques so have more negotiating power. Sovereign-wealth funds, for instance, a few of that have begun carrying out their buy-outs in-house, merely will likely not spend “2 and 20”.

It's the 2% “management” charge this is certainly underneath the most stress. These types of a large fee merely to maintain the lights on had previously been quickly glossed over when copper-bottomed investments yielded 3 x that; it really is harder to protect at a time of rock-bottom interest rates. As companies have actually ballooned in proportions the administration charge has come to represent tens of millions of dollars—far over the costs the companies concerned actually bear, regardless of how plush their particular workplaces. Some investors have taken to examining a fund’s flowing costs to make sure its employers aren't getting rich just by arriving to function.

YOU MIGHT ALSO LIKE