Fund: Hedge Replication ETF

Ticker Symbol: HDG

Intraday Ticker: HDG.IV

Investment Goal: Seeks investment outcomes (before charges and costs) that track the overall performance of Merrill Lynch Factor Model – Exchange Series (MLFM-ES).

Gross Expense Ratio: 2.06per cent

Expense Ratio: 0.95%*

Bloomberg Index Symbol: MLEIFCTX

seeks to generate the chance and return characteristics of a broad universe of hedge resources while avoiding or conquering lots of the challenges of purchasing a hedge fund.

Hedge funds: The charm… in addition to challenge

Numerous investors are aware of the potential risks of trading just in conventional asset classes like stocks and bonds. They might be looking for variation through alternate investments like hedge resources.

- But hedge resources happen unrealistic for several investors since they usually restrict access, have large investment minimums, or can be closed to brand-new investment.

- A method generally hedge investment replication may provide a substitute for investing right in a hedge fund—without those difficulties.

What exactly is aspect replication?

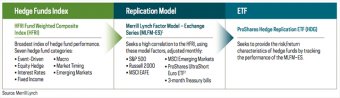

Hedge investment replication is a quantitative, rules-based method that tries to replicate the risk and return profile of a diverse world of hedge resources.

Factor replication is one particular replication approach:

- Determines combinations and weightings of economic market aspects, such as for instance list comes back

- Seeks large correlation with hedge investment overall performance

Hedge investment comes back are mostly produced from experience of marketplace factors, in accordance with educational analysis.

How Hedge Fund Replication Works

Investment process

Broad list of hedge investment overall performanceHFRI, an index of hedge resources:

- Signifies over 2, 000 hedge resources and many different investing types

- Was created by Hedge Fund Research, Inc., an international frontrunner when you look at the alternative assets industry

MLFM-ES, which targets a top correlation to HFRI:

- Is designed to reproduce the part of hedge investment returns attributable to market visibility

- Updates element weightings month-to-month making use of HFRI performance data

- Ended up being established by Merrill Lynch, a pioneer in hedge investment replication

HDG seeks contact with market factors underlying MLFM-ES:

- Obtains publicity through easily available, liquid and marketable securities or types

- Invests in equities, ADRs, derivatives like swaps, forwards and futures, and U.S. Treasury expenses

- Will not invest straight in hedge resources

Features of HDG

Unlocks the possibility of hedge resources

YOU MIGHT ALSO LIKE