Whilst the monetary news is infested with marketplace pundits dispensing knowledge in what forms of trading methods will work, you can find few, if any, talking heads in a position to discuss exactly what managers and strategies are now actually being financed with any amount of authority.

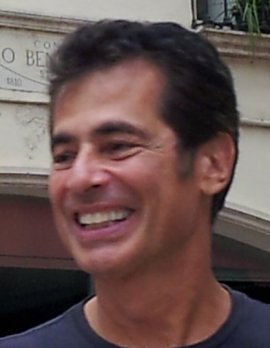

Richard Taglianetti, senior managing manager of hedge funds at Corinthian Partners, is regarded as these choose few. In the last decade, he's raised hundreds of millions for start up hedge fund supervisors and gained a romantic understanding of the appetites of institutional people.

Richard Taglianetti, senior managing manager of hedge funds at Corinthian Partners, is regarded as these choose few. In the last decade, he's raised hundreds of millions for start up hedge fund supervisors and gained a romantic understanding of the appetites of institutional people.

Taglianetti built a strong clientele as a futures agent at Prudential Securities in which he found a winning formula: determine gifted young cash supervisors and introduce all of them to smart people just who could recognize both the threat and incentive in financing all of them. After making Prudential, Taglianetti, understood affectionately as “Tags” in the industry, relocated to Corinthian Partners. Subsequently, he's effectively raised money for alternate managers from a diverse buyer base, globe-hopping in a seemingly effortless mix of business and enjoyment.

Taglianetti features a simple design: he provides what the marketplace desires. With 60 institutional people on both edges associated with Atlantic looking for their counsel, he definitely has actually his hand in the pulse associated with hedge investment business.

Company in Canada had the opportunity to speak with Taglianetti for their take on the state of play inside hedge fund world and find out exactly what gets financed nowadays.

While no-one strategy appears to be specially well-known, he outlined what institutional investors are looking for from a hedge investment. “They want a manager that has a logical, scalable procedure with lasting comes back, institutional infrastructure to allow for capacity, and institutional-quality danger administration, ” he stated. Taglianetti emphasizes that risk-adjusted returns are of important importance, as is the capability to make money in both booms and busts.

In Canada, hedge funds’ total assets under administration are simply 2 percent of exactly what their particular counterparts in the usa manage. Whenever speaking about this modest-sized marketplace, Taglianetti granted difficult to Canadian hedge investment supervisors. “i've been carrying this out for 13 many years, and I also put out an international search, ” he said, “and I’ve had maybe three Canadian managers step up to the dish. If there was some guy in Canada who was simply carrying out, I Might want to speak to him.”

Taglianetti states the institutional investors he advises tend to be geographically agnostic, and although they are doing examine Canada as an asset course, they just do not establish a situation through Canadian hedge funds. Afterwards, he had been able to followup with Business in Canada on which is inhibiting the rise of Canadian hedge fund business.

He's additionally vital for the current overall performance of hedge funds, asserting that “the entire business is going to give you one-story, but the the reality is that individuals needed men who have been positive in September.” Besides, Taglianetti fears that hedge funds have actuallyn’t discovered their lessons from economic crisis.

“It appears like most are in identical trade, ” he stated. “They’re all correlated, and they’re maybe not incorporating any worth in opportunities that they’re taking.

“That’s an accident waiting to occur.”

Below is a transcript of company in Canada’s interview with Richard Taglianetti, softly modified for clarity.

BiC: Part of everything do is help hedge resources secure an excellent money base. So what’s getting funded nowadays? Do any methods or asset classes look like particularly attractive at this time?

RT: Again, it is sorts of simple from where I sit, we raise cash for many different investors, all institutional, and I have a broad base of people, about 60, on both sides of Atlantic, all European or in the U.S. We haven’t done a great deal in Asia.

I’m entirely customer-driven, and my model is simple: We provide what industry desires. The two biggest hedge resources centers are the U.S. in addition to U.K., and you really get a taste of what everybody’s selecting if you assist a few of the largest players, the largest people, in those two facilities. As well as the methods – within that trader base of 60, there are fund of resources, multi-strategy resources, private banking institutions, and select an entirely diversified mix.

BiC: But there needs to be some typically common threads among them.

RT: the normal bond through all of the allocators would be that they wish a manger that has a logical, scalable procedure with sustainable returns, institutional infrastructure to accommodate capability, and desire to see institutional-quality risk management within the store, in which a person except that the profile supervisor oversees risk administration.

So that they look for any type of a technique, eventually, who has good risk-adjusted returns. I happened to be only running through a number of the stats on all hedge funds, and I also pointed out that Millennium features returns that I’d call boring – they’re since smooth as can be. You’ve got a 10.8 % three-year annualized return with a SHARPE greater than 2 and its particular assets tend to be $18 billion. So they don’t capture the lights-out, but they’re the bucks sign-up, and that’s the reason why they’re attracting assets.

BiC: That variety of constant return, that’s exactly what folks for the reason that room are searching for, appropriate?

RT: Yes. But I’m afraid also – we saw the S&P had its very first down month final thirty days in we don’t know-how many months, perhaps 16 months, and all sorts of the hedge resources got clocked for the reason that thirty days also it was their particular biggest down month in an exceedingly, long time. Therefore I’m afraid many of these managers didn’t learn much from October 2008. It seems like most are in the same trade, they’re all correlated, and they’re perhaps not including any price when you look at the positions that they’re taking. What exactly we look for is an absolute return generator, like Millennium, helping to make cash day in and outing. More desirable strategy tend to be guys that make money in and out, day in and outing, and so are shortly biased.

Initially, whenever hedge resources actually came to be inside 90s, the areas weren’t crowded and additionally they were exploiting the Bacons in addition to Joneses, they were making macro bets, and, once they extended, they were exploiting inefficiencies.

Now the areas are far more efficient so nobody’s really producing a return without getting levered and very long. That’s a major accident waiting to occur.

BiC: With regards to younger emerging managers. How have their leads been in regards to acquiring financing?

RT: There’s a top death price amongst appearing supervisors – not many of them survive. So people are searching a lot more closely if they perform their research to make sure. Six years back institutional investors would fund two guys who were working-out of their garage should they had a good, systematic design. Today, similar investors are seeking institutional-quality infrastructure, but much more the power or plan to include it because they grow. Therefore they’re more careful inside their approach to growing supervisors.

YOU MIGHT ALSO LIKE