With the S&P 500 showing triple digit comes back because the financial crisis, we’ve noticed there have been more and more magazines denouncing hedge resources as under performing the S&P 500. We also got in from the trend also, in a somewhat different method than most.

With the S&P 500 showing triple digit comes back because the financial crisis, we’ve noticed there have been more and more magazines denouncing hedge resources as under performing the S&P 500. We also got in from the trend also, in a somewhat different method than most.

Plus in other news…oranges don’t taste like bananas RT : Hedge Funds Trail S&P 500 YTD

— Attain Capital (@AttainCapital)

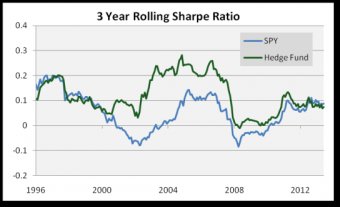

The issue with saying hedge funds are underperforming the S&P 500 is the fact that the grand almost all them aren’t also attempting to overcome the S&P 500 in comes back, for just about any ready period. They have been attempting to provide better risk modified returns compared to stock exchange, but that doesn’t lead to nearly as good of a headline. “Hedge funds post .026 much better Sharpe ratio over trailing 36 thirty days duration” only doesn’t have that ring to it.

The problem is, as increasing numbers of hedge fund like products make it into so-called ‘liquid type’ via a mutual fund or ETF or perhaps the like; more and more daily investors can access them, plus plus sites also portfolio resources which compare overall performance to shares automagically are going to be offering within the S&P 500 as the benchmark when it comes to Alternative Funds performance. It turns out many folks are picking up with this oranges and orange comparison, with Joe Light from the Wall Street Journal weighing in recently together with his article “”

“If an investment deliberately hedges its experience of stocks, it really isn’t actually reasonable to say your fund did well in 2008 or defectively in 2013, states Jonathan Boersma, head of professional requirements and a benchmarking expert in the CFA Institute. The issue is it wasn’t really built to beat the S&P 500 during up markets to begin with.”

So what should people in Alternatives benchmark their particular assets against? Mr. Light has actually two important aspects to consider prior to trying evaluate a hedge fund to any such thing.

“The first rung on the ladder: determine what you might have invested in as an alternative. Another yardstick: What does the investment manager state his ultimate objective is?”

YOU MIGHT ALSO LIKE

![[PDF] The Handbook of Managed Futures and Hedge Funds](/img/video/pdf_the_handbook_of_managed_futures.jpg)