inside U.S., Tiger Global and T. Rowe cost tend to be leading the cost among hedge funds and shared funds investing in technology startups. Here's exactly how 2014 spiked.

inside U.S., Tiger Global and T. Rowe cost tend to be leading the cost among hedge funds and shared funds investing in technology startups. Here's exactly how 2014 spiked.

Last January, we identified that hedge investment and shared fund supervisors had been progressively contending for and winning later-stage discounts within the venture spending world. And 2014 saw that activity spike, as asset managers jumped into businesses including AirBnB, Cloudera, Dropbox and Uber among dozens of others.

These asset management firms are becoming extremely energetic (late-stage) people into the billion-dollar club and frequent drivers associated with the biggest funding discounts in technology these days.

But whilst boom in hedge investment and shared investment technology investing is easily noticeable, we wanted to make use of CB Insights information to highlight precisely how hectic the resources are becoming and just who among the list of batch had been more active compared to rest. The information here.

More than 500 of tech's most extremely appreciated exclusive businesses. Showcasing the companies, people, and trends among tomorrow’s disruptors.

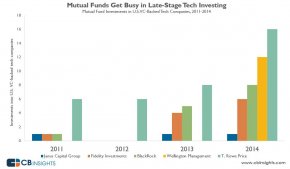

T. Rowe Price leads shared fund cost

The chart here shows the investment deal styles of five shared funds – BlackRock, Fidelity Investments, Janus Capital, T. Rowe Price, and Wellington control – into U.S. VC-backed technology organizations throughout the last four many years. Outside of Janus, 2014 is definitely the largest year for every regarding the shared funds investors just who finished between 6-16 U.S. deals each.

Particularly, T. Rowe Price increased its private tech deals into venture-backed startups by 2x in 2014. And after no U.S. tech discounts in 2013, Wellington Management jumped into 12 discounts including a $70.9M investment into real estate technology system Redfin as well as a $40M round into Boston-based cybersecurity business Veracode, which recently disclosed IPO plans.

Tiger worldwide outpaces hedge resources

Hedge funds in addition became more energetic in 2014 yet not toward same degree. Once the chart below shows, Tiger international Management far outpaced hedge fund people in U.S. VC-backed technology companies with over 25 investments over the 12 thirty days period including Quora, Credit Karma, Actifio and Thumbtack.

Outside of Tiger though, hedge funds were more tempered in package speed. Dragoneer, a San Francisco-based long-only, growth-oriented public and personal buyer, was second most energetic among the batch of hedge resources counting significant opportunities including Instacart, AirBnB and Wealthfront. Coatue Management, which exited both Lending Club and Box in 2014, did not see an uptick in deals on a year-over-year foundation.

YOU MIGHT ALSO LIKE