A investment manager without a Bachelor’s Degree shares the secrets to which makes it huge in hedge fund business

A investment manager without a Bachelor’s Degree shares the secrets to which makes it huge in hedge fund business

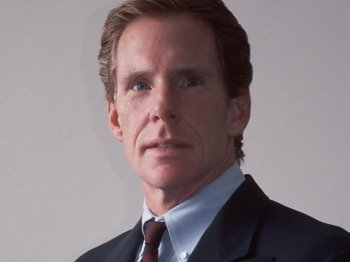

Don Conrad has arrived quite a distance. As an adolescent inside tiny Long Island hamlet of Port Washington, Conrad worked the evening move at a factory. He operated a pinion-best called a device with toothed gears.

Conrad invested a-year in Boston seeking his imagine getting an expert percussionist. He attended night college at Nassau Community university in longer Island, never earning a bachelor’s degree.

Now a fruitful hedge investment supervisor, exactly how has actually Conrad thrived in a business chock-full of Ivy League pedigrees and higher level levels?

“We have a PhD from college of tough hits, ” Conrad said.

Don't be mistaken—succeeding as a hedge fund manager isn't easy. However for visitors that have the chops to beat the marketplace and the abilities to pitch new clients, the barriers to entry aren't up to one might believe.

Really, anybody can start a hedge investment.

The payoff is financially rewarding. The typical fee structure for hedge investment supervisors, known as “2 and 20, ” provides 2 per cent of assets under management and 20 per cent of gains to finance supervisors annually.

So a rather little hedge fund with ten dollars million under management will net the supervisor $200, 000 even in a down year. And in case the fund returns 12 per cent, the supervisor will make $440, 000. If you can grow the dimensions of your fund, those figures can balloon in to the billions. 2011’s greatest making investment manager, Bridgewater Associate’s Ray Dalio, reportedly received $3.8 billion that 12 months.

That’s pretty good for a business where a man like Conrad can work his solution to being a market-beating investment manager based on skill and grit without fancy qualifications. Having started their economic solutions profession in 1981, Conrad’s fantastic hair is slicked straight back exposing a receding hairline. He's held with their other enthusiasm, the drums, playing in latin songs and R&B rings and their studies at a York music school. He speaks using the aura of a person who has made his keep without any shortcuts.

Their very first work was at sales, hocking a business relationship earnings investment. Conrad ended up being recruited to a strong known as E.F. Hutton business, later called Shearson Lehman Hutton, in which he worked his way-up to a Senior vice-president position. Indeed there, then at Lehman Brothers, last but not least at PaineWebber he built a track record advising large net worth clients.

YOU MIGHT ALSO LIKE