Holdings week could be the just few days of every one-fourth once the Novus ping pong table is not utilized as intended. Rather than playing an agreeable match as some slack from coding or number crunching, our experts and designers make use of it as a buffet table laden with convenience meals to keep all of them humming through the entire week. Exactly 45 days after quarter end, the SEC releases a treasure trove of information on a huge number of hedge fund managers via kind 13F, therefore we process and evaluate everything.

Holdings week could be the just few days of every one-fourth once the Novus ping pong table is not utilized as intended. Rather than playing an agreeable match as some slack from coding or number crunching, our experts and designers make use of it as a buffet table laden with convenience meals to keep all of them humming through the entire week. Exactly 45 days after quarter end, the SEC releases a treasure trove of information on a huge number of hedge fund managers via kind 13F, therefore we process and evaluate everything.

That was final Monday. We’ve currently delivered most of our insights to consumers, and from now on we should share some main points with the rest for the financial investment neighborhood. This post will summarize the data from over 1, 000 hedge investment supervisors, across the 15.5 thousand securities they’re invested in, addressing over $2T in marketplace worth. We will consider individual securities that saw the most hedge fund activity in Q3. Let’s dive in.

Most Widely Used Hedge Fund Stocks

For many years, Apple typical stock was the absolute most highly-owned protection across our hedge investment world (HFU). This goes on today, although trend since Summer of just last year (whenever HFs presented an enormous place) is a net sell for Apple among hedge resources. In fact, 104 hedge resources reduced their opportunities and 28 offered totally last quarter. The current wide range of resources spent is 236, followed by Google and Microsoft at 196 and 190, respectively. Largest holders among hedge funds are Icahn and Greenlight.

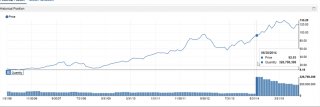

Apple: Price vs. Hedge Fund Range Shares Held:

Allergan has additionally been regarding the radar for a time, plus after their merger with Pfizer, the brand new company is expected become among the list of top three most highly owned securities. The biggest HF holder is Viking worldwide while they increased their place in Q3.

Allergan has additionally been regarding the radar for a time, plus after their merger with Pfizer, the brand new company is expected become among the list of top three most highly owned securities. The biggest HF holder is Viking worldwide while they increased their place in Q3.

Allergan: Shares Held by Hedge Funds:

Most Bought Hedge Fund Stocks

PayPal started trading in July after a spinoff from eBay, now boasts opportunities from 114 hedge funds, in comparison to 104 hedge resources in eBay since 9/30. it is currently the many purchased safety in Q3, but that should be tempered, as e-bay holders obtained some shares on IPO. Icahn may be the biggest hedge fund holder, unsurprising as he features forced when it comes to spinoff in his activist campaign targeting e-bay. He bought PayPal and offered his entire eBay position in Q3. Mason Capital, D.E. Shaw, and Soros all hold substantial positions in the repayment business.

Another business that saw large-scale buying from fund supervisors is Gilead Sciences (GILD). On a web foundation, 55 managers included with the position with 22 resources initiating and 73 contributing to their particular place, taking the total fund matter to 163. Even though cost did nothing throughout the last 12 months, resources are still generally good regarding the pharma study business that develops HIV and Hepatitis medication. The biggest holders for title tend to be D.E. Shaw, Adage, lover Fund, and multiple quant resources. Most funds with large numbers of shares, hold very small positions indicating minimal conviction into the investment.

Amazon (AMZN) is a quite various story. Wet’s one of the largest net buys at 34 net managers, but its holders include some of the most renowned fundamental L/S equity shops like Tiger Global, Viking, and Lone Pine, each investing in the name in significant size.

Amazon: Cost vs. Hedge Fund Amount Of Shares Held:

Many Sold Hedge Fund Shares

Icahn ended up beingn’t alone to exit from eBay. Managers exited in droves following the spinoff. Net, 70 managers offered or paid off their particular opportunities with 39 present totally, Icahn, Lone Pine, Perry, Jana, and Maverick one of them. Other extremely offered brands include Coca-Cola, Medtronics and du Pont.

Healthcare: Deerfield vs. Palo Alto

A look at two successful supervisors just who survived the VRX crisis.

Medical is a well liked of hedge fund managers, with nearly 5percent devoted to the industry. This is becoming expected. If you’re likely to spend a specialist to simply help spend money on the marketplace, medical appears like the place. Healthcare shares exhibit very wide dispersion amongst the most useful and worst doing securities, which makes it attractive for managers picking long and short opportunities.