Managed futures, the outdone down, mathematically-based hedge funds group, ended up being up 5.02 % in August, effortlessly the utmost effective carrying out option investment method in August. The strategy performed well during marketplace volatility of 2008 and contains generally speaking struggled since.

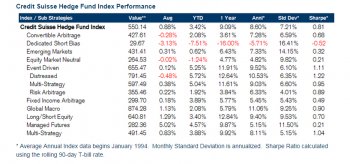

The frequently algorithmically driven, price momentum-based managed futures method, with 5.02 per cent monthly list performance, edged out extended / brief strategies, which had just 1.29 % monthly performance, according to Credit Suisse Hedge Fund Index overall performance data.

Event driven hedge funds posted 0.12%t good comes back

More famous strategy 12 months currently, activist hedge resources, usually come under the “Event Driven” category, uploaded 0.12 percent positive comes back in August. The strategy is up 5.25 % year to date. Compare this with all the occasion Driven, Distressed subcategory, up 5.72 percent year currently, to look at top performer. Distressed hedge funds typically find value in bankruptcy plays or debt that is being shed by more conservative investors. Buying Argentine debt by Paul Singer’s NML Capital, by way of example, might be a good example of distressed debt investing, alongside distressed European bonds.

“August seems is a good month for several managed futures strategies, with trend followers particularly successful, ” James Skeggs, Global Head of Advisory Group at Newedge, stated. “There are good reasons to be upbeat about comes back for CTAs, with 2014 YTD performance in the black, and now we are seeing much more investors getting contemplating the room once again.” Confirming the Credit Suisse data, the Newedge Trend Index, a momentum-based moving average cross formula designed to replicate trend following programs, rebounded from a -1.06 percent return in July showing +5.40 per cent the thirty days, even though the Newedge Trend Indicator posted and even more positive +10.89 % for thirty days. The Newedge CTA index, a study of performance associated with biggest CTAs, had been up just 3.89 per cent from the month.

Managed futures places in third location with 11.50per cent standard deviation

In terms of volatility, managed futures ended up being nearby the the top of record, using 3rd location with 11.50percent standard deviation. Probably the most volatile for the strategies was Dedicated brief Bias, with a 16.41 percent and promising Markets came in second location at 14.15 %. The Credit Suisse information failed to break apart upside and downside deviation, which in these there very volatile benchmarks would inform a tremendously various tale.

When considering risk and reward, Event Driven, Distressed strategy topped the list at a Sharpe ratio of 1.22, while the garnered to the Event Driven strategy was second at 1.11. Other top perfuming hedge resources on a risk reward foundation included Multi-Strategy resources, worldwide Macro and danger Arbitrage. People that have the least appealing risk-reward pages, centered on Sharpe Ratio, included Managed Futures and Equity Neutral Market methods, which have considerable overlap. Emerging areas and Fixed Income Arbitrage also exhibited bad long-lasting risk-reward measures.

YOU MIGHT ALSO LIKE