Tiger international to Valiant Capital boost discounts to tech startups in 2013. Surging late-stage consumer tech valuations have-been driven to some extent because of the influx of hedge resources and mutual resources increasingly investing in tomorrow's large leaflets.

Tiger international to Valiant Capital boost discounts to tech startups in 2013. Surging late-stage consumer tech valuations have-been driven to some extent because of the influx of hedge resources and mutual resources increasingly investing in tomorrow's large leaflets.

With tech overall performance when you look at the public areas surging and an increasing option of late-stage capital, the number of private technology businesses inside billion-dollar valuation club is increasing. And among the list of growing set of people competing for and winning discounts to back tomorrow’s tech high-flyers tend to be hedge resources and shared funds.

While many venture people like SoftTech VC’s Jeff Clavier have actually known as the influx of the latest hedge investment money “scary, ” the truth is that the substantial systems, public areas analysis experience and deep pouches among these asset management organizations have actually won over many later-stage pre-IPO startups. For example, HotelTonight CEO Sam Shank informed Business Insider of hedge fund backer Coatue Management:

“They have an individuality … they’re well-connected and really knowledgeable — they've a whole new share for all of us to network in.”

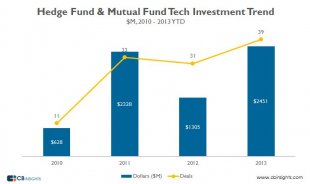

From Valiant Capital Partners to T. Rowe Price, seven hedge fund and shared fund corporations (detailed below) have actually took part in 114 discounts to tech startups totaling over $6.7 billion in disclosed funding because the beginning of 2010 predicated on CB Insights exclusive organization funding information. That firms plainly ratcheted up package activity in 2013 participating in just under 40 personal technology deals versus fewer than 15 in 2010. While 2011 saw shared investment and hedge investment managers diving into massive consumer technology funding rounds to businesses like Groupon and Zynga, 2013 in addition saw investment levels with participation by these corporations struck a four-year large.

By far the most active private tech buyer regarding the money supervisors analyzed is Tiger worldwide Management, created by Chase Coleman. In 2013 alone, Tiger Global completed over 20 disclosed deals to organizations including Warby Parker and Flipkart to Glassdoor and Nextdoor. Tiger international was among the most active businesses in Asian e-commerce businesses as well.

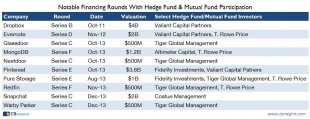

Inside our previous research, we detailed the billion-dollar club nowadays is essentially comprised of consumer technology companies. And surging late-stage customer tech valuations being driven partly by the increase of Wall Street people on Sand Hill Road. The table below features a variety of technology valuations in current investment rounds with participation by hedge resources and/or shared resources, including a number of the startups now respected at $1B+ from Evernote to Pinterest.

The hedge resources and shared funds analyzed for this study quick tend to be detail by detail here. All of their underlying organization & buyer information are present in the CB Insights capital raising database.

- Altimeter Capital

- Coatue Management

- Fidelity Investments

- Maverick Capital

- T. Rowe Price

- Tiger Worldwide Control

- Valiant Capital Partners

Note: A spreadsheet of all the financing deals most notable analysis can be acquired on ‘Research’ loss, after signing into to CB Insights. is only available to clients with access to CB Insider.